Bond Markets Not Yet Believers

The S&P 500 Index has rallied mightily off of its March 23 low, climbing almost 40% through the close of the market yesterday, as market participants look ahead to the economy continuing to gradually reopen. While there are signs that bond market participants’ overall assessment of the economy is slowly edging toward a similar outlook, it’s hard to call them true believers yet.

“Bond markets do tend to be more cautious than stock markets,” said LPL Equity Strategist Jeff Buchbinder. “As a result, historically we often get earlier warning signs from bond markets when things are about to go sour, but equity markets may have an edge in signaling the potential for an economic turnaround.”

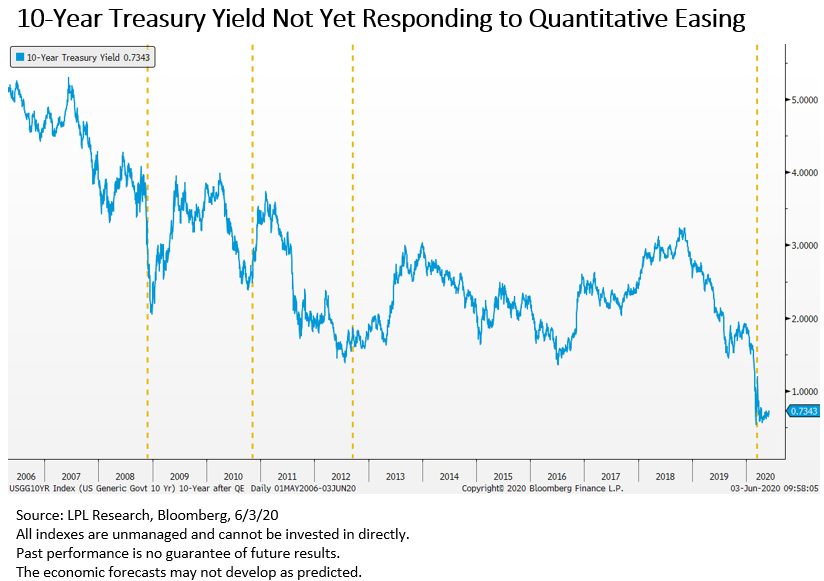

As shown in the LPL Chart of the Day, while the 10-year Treasury yield has advanced in recent months, the move off the bottom remains muted, and the 10-year yield remains lower than where it was when the S&P 500 bottomed March 23. It makes for an especially strong contrast with the start of prior periods of Federal Reserve (Fed) bond-buying, or “quantitative easing,” when 10-year yields started to rise more robustly as markets began to anticipate stronger economic growth, although it could still be early.

Nevertheless, there are some positive signs in current bond markets. While Treasury yields haven’t moved much, they are moving in the right direction. Investment-grade and high-yield credit spreads continue to contract, a sign of economic confidence. We are seeing some steepening in parts of the yield curve (the difference between longer-term and shorter-term Treasury yields), usually also a positive economic signal. Perhaps most important, Fed policy has helped resolve some of the bond market dislocations we saw when market stress was at its highest.

There are several forces in play keeping bond yields restrained independent of growth expectations. Inflation remains low, and there’s likely to be minimal inflationary pressure as the economy recovers. US Treasury yields remain attractive compared with other developed economies. Finally, the Fed and other central banks are buying bonds, creating added demand.

Assuming no major setbacks in reopening the economy, we expect Treasury yields to become more responsive to the economic environment over time and drift higher, but looking into 2021, we think the likelihood of a significant, sustained move higher remains low.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All index and market data are from FactSet.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05018166