Coupon Clipping for Investment Income

What can we learn about investment income opportunities from coupon-clipping environments? From 1977 to 2019, the price of the Bloomberg Barclays US Aggregate Bond Index rose in 22 calendar years and fell in 21 years, but, adding in the index’s coupon income, the index rose in 40 of 43 years. (The down years were 1994, 1999, and 2013.)

“While investors don’t clip actual bond coupons anymore, investment income is still essential for many investors, and has also provided an important cushion against possible price losses,” said LPL Financial Chief Investment Officer Burt White.

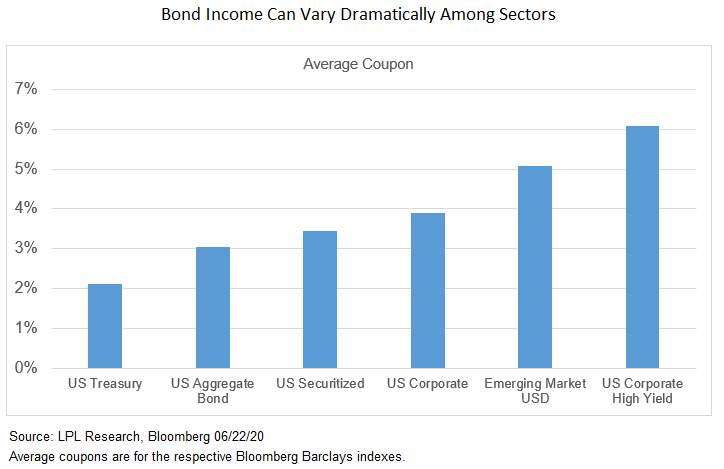

As shown in the LPL Chart of the Day, the average coupon for different bond sectors can range quite a bit, from a little over 2% for Treasuries to just over 6% for high-yield bonds. Those differences come with a catch—higher income usually means higher risk.

When bond prices don’t move a lot, most of their return comes just from the income, a “coupon-clipping” environment. Even when bond prices move a little lower, the total return can remain positive because of the coupon income, as it has 18 of 21 times when bond prices declined since 1977.

The current historically low coupons leave a smaller cushion for income to offset price declines, creating more concern about a rising rate environment (bond prices fall when interest rates rise). While we do expect Treasury yields to rise over the second half of the year, continued support from the Federal Reserve, little inflationary pressure, and still-attractive yields compared with other international developed countries should help limit the size of the move. With the gains from price increases in the first half of the year already in hand, we expect something like a coupon-clipping environment over the entire course of 2020, with greater diversification benefits should we see another market downturn.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Bloomberg Barclays US Aggregate Index: The US Aggregate Index covers the dollar-denominated investment-grade fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS pass-through securities, asset-backed securities, and commercial mortgage-based securities.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05025252