Federal Reserve Preview: Trick or Treat?

With a series of important economic indicators suggesting the economy is declining and inflation is finally decelerating, albeit very slowly, markets are beginning to factor in that the Fed may soon transition to a less aggressive stance in early 2023. Here we preview this week’s Fed meeting and discuss whether investors will get a trick or a treat.

A TIME TO DOWNSHIFT

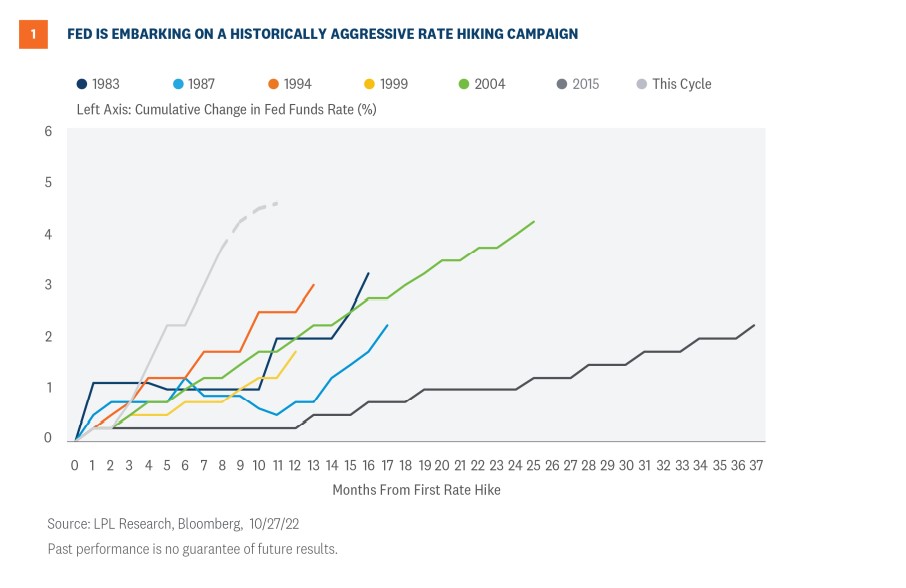

Although Federal Reserve (Fed) Chairman Jerome Powell has repeatedly stressed the Fed will “keep at it,” he also noted at the end of September the Fed would soon be approaching the time to slowdown. There are calls from within the Fed that it is now time for the Fed to downshift rate increases as the economy responds to earlier rate hikes [Figure 1].

The statement the Fed will release at the conclusion of the meeting is key for the markets, and even more important for markets is what Powell will say during the following press conference. Always looking ahead, the market will be on alert for any indication of what the Fed may do at the December 13-14 FOMC meeting. The fed funds futures market is increasingly forecasting a 0.50% increase in December.

THE ECONOMY SLOWS BUT INFLATION FOLLOWS TOO SLOWLY

A broad range of data releases, from manufacturing and manufacturing input costs, used cars, gasoline prices, housing, rent, household spending, job openings, and money supply indicate that growth is easing and inflation is moderating as higher rates take their toll on the economy.

As odd as it may seem, used car prices were one of the first signs that inflation was beginning to take hold. Prices rose dramatically as a shortage in semiconductor chips and other necessary products for vehicle manufacturing were in short supply due to pandemic-led supply chain challenges. Used car prices have fallen steadily since, reaching near normal levels as the auto industry has ramped up production.

The steady climb in mortgage rates to over 7% for the first time since 2001 has stopped the parabolic rise in housing prices. Prices are now coming down across the country for new and existing homes.

Rent, an important component of the Consumer Price Index (CPI), constitutes 32.8% of the total CPI. It has been slow to register decelerating prices, but the latest industry surveys point to a leveling off of the surge in rents. As soon as this begins to register in the CPI, total core inflation will begin to proceed lower at a steadier pace.

Slower manufacturing activity is evident in a broad range of respected surveys, while input costs in the manufacturing process are now turning lower.

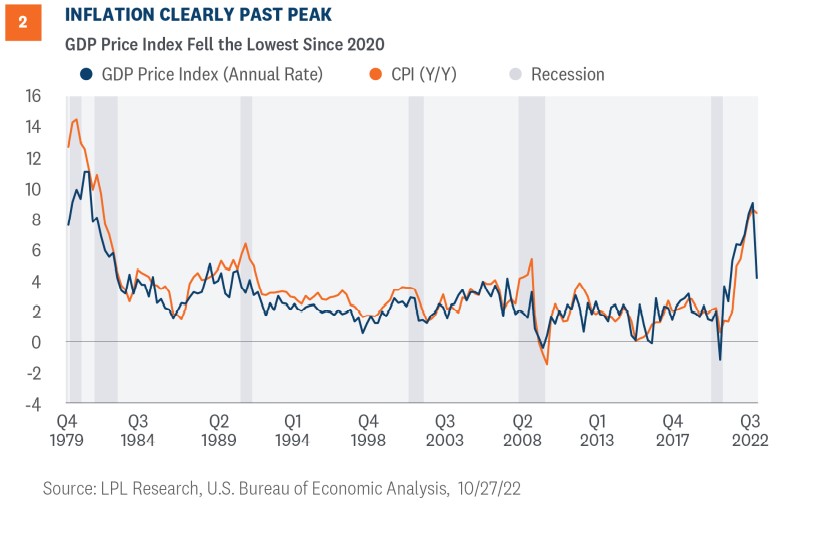

Though they’ve inched higher this month, gasoline prices have pulled back substantially from their peak at the beginning of the summer. This has helped anchor consumer perceptions of inflationary trends over one to three-year periods. The Fed has more work to do to break the back of inflation, but clearly inflation is past its peak [Figure 2].

As the Fed tries to weaken an emerging wage/price spiral, higher prices are easing into rising wages, and higher interest rates and concerns over a possible recession have led to fewer job openings; but at this point, it is not enough. In September, there were 10 million job openings for roughly 6 million potential workers, giving new employees the upper hand in seeking higher wages. Expectations are the economic slowdown will become more pronounced, and as the lagged effect of cumulative rate hikes works its way into the broader economy, the unemployment rate will rise and the number of job openings will continue to fall.

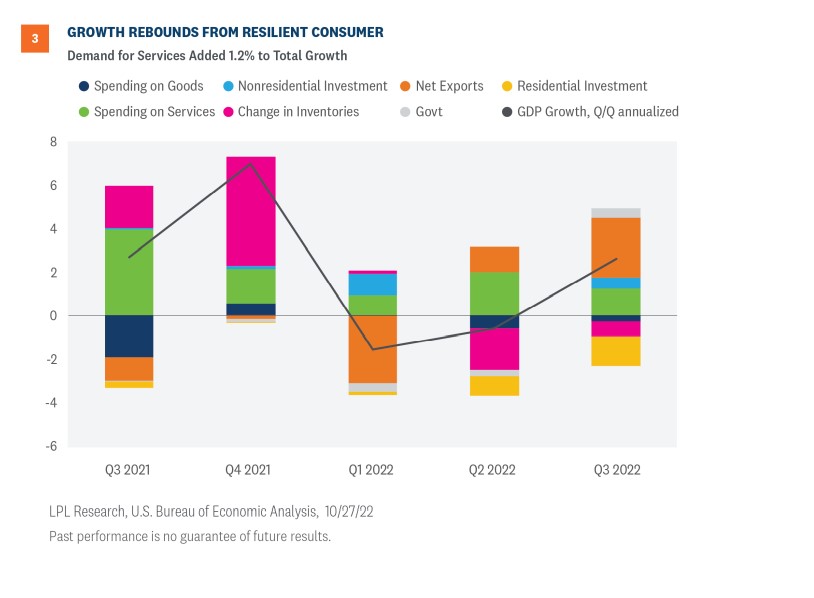

After two consecutive quarters of negative growth, the U.S. economy grew at a 2.6% annualized rate in the third quarter, driven by a resilient consumer sector. Real personal spending, roughly 70% of the economy, grew 1.4% annualized, slightly slower than the previous quarter [Figure 3]. The U.S. is not currently in recession given the strength of the consumer sector. However, excluding the more volatile categories, the trajectory for growth looks weak, and recession looks increasingly likely next year. Consumers will be the linchpin for the likelihood of a soft or hard landing. A deteriorating housing market, nagging inflation, and an aggressive Fed put the economy on unsure footing for 2023. A silver lining is markets may have priced in much of the near-term recession risks.

INFLATION CONCERNS HAVE SHIFTED TO RECESSION FEARS

Chairman Powell initially described the economic downturn that would ensue as the interest rate campaign began as a “soft landing,” followed soon after as a “soft-ish landing” as it became increasingly clear that tackling inflation was going to require a heavier dose of higher rates.

More recently, Powell has acknowledged that a recession may unfold as inflation has become more challenging, with higher rates needed. What is fundamental for the market is how deep a recession is expected and how it might affect demand and corporate America’s operating margins.

CONCLUSION

Although market participants anxiously await the end of the Fed’s rate hike cycle, they do not want the Fed to pause long enough to allow inflation to continue to build and leave an economic underpinning of stagflation. Chairman Powell has repeatedly made the point that the stop and start Fed policy in the 1970s, led by Arthur Burns, was a mistake as it allowed stagflation to build and made tackling it much more difficult. He has repeatedly alluded to the success brought by Paul Volcker, the Fed Chairman who brought inflation down dramatically and forcefully.

Still, some Fed members are becoming increasingly vocal as they seek to begin the discussion about stepping back despite high inflation. As a recent Bloomberg headline so aptly implied: Is Powell going to maintain his inner Volcker or emerge as a latter day Arthur Burns? We may have the answer, or at least some clues, in the coming meetings.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Tracking # 1-05343017 (Exp. 10/23)