Job Growth Bounces Back in October

The October payroll report more than delivered on expectations for a bounce back from the soft September report.

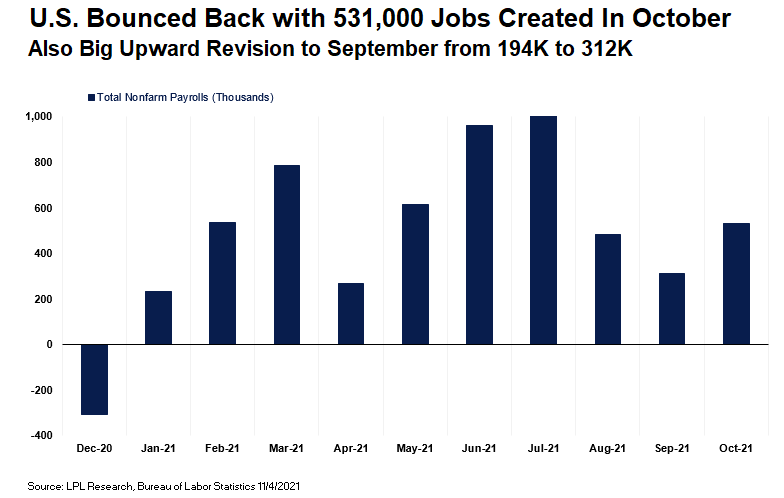

The U.S. Bureau of Labor Statistics released its October employment report this morning, revealing that the domestic economy added a solid 531,000 jobs during the month, exceeding Bloomberg-surveyed economists’ median forecast for a gain of 450,000. This comes on the heels of a weak September report, originally reported at 194,000 but revised this morning up to 312,000, as shown in the LPL Chart of the Day. The previous two months were revised up by 235,000 combined.

The good news didn’t stop there, with very strong job gains in the private sector (604,000 vs. expectations of 420,000), the biggest such gain since July, and a 0.2% dip in the unemployment rate from 4.8% to 4.6% (compared with expectations at 4.7%).

If there is a downside to this report it’s that the labor participation rate stayed historically low at 61.6%, though the participation rate for prime age women workers (25-54) did tick higher by 0.1% (for men the rate was unchanged at 88.1%). That may be related to schools fully reopening. More broadly, the end of supplemental unemployment benefits, increasing comfort with COVID-19 risk as cases fell, and the attraction of higher wages likely also contributed to the strong job gains.

“This is the strong progress from the job market that we wanted to see,” noted Jeffrey Buchbinder, LPL Financial Equity Strategist. “Some of the pandemic-driven headwinds preventing people from taking open jobs have started to abate, and given strong demand, we expect to see even better numbers in the months ahead.” Still, the work is not over with still 4.2 million fewer employed than the pre-pandemic peak.

Digging deeper into the details of the report, gains were broad-based. Leisure and hospitality jobs rose 164,000, nearly double their September increase; professional and business services added 100,000; and manufacturing had its best month since June 2020, up 60,000. Construction job gains were solid too, up 44,000, while temp hiring rebounded strongly, with a 41,000 increase.

Turning to the inflation side, the year-over-year increase in average hourly earnings was in line with expectations at 4.9% (+0.4% month over month), but, more specifically, wages for leisure and hospitality jobs are up more than 11% year over year and indicative of the labor supply challenges.

While this report is solid, and wage inflation depending on the measure is running at 5-6% annualized this fall, it is unlikely to change anyone’s expectations for the Federal Reserve’s timetable for liftoff. The market continues to price in two rate hikes by year-end 2022, which we think is too aggressive. We expect the initial rate hike in early 2023, though if we continue to see big job gains like today’s report, certainly one hike at the very end of 2022 is possible.

Overall, this report signals that recent economic slowdown was likely largely a response to the Delta variant. More labor supply is not a certainty but we see a number of reasons to anticipate more people getting back to work and even bigger private sector job gains in November and December. We await further evidence, but this does support the picture of a positive environment for equities as we look toward 2022.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05209864