Leading Indicators Show Tempered Optimism for Economy

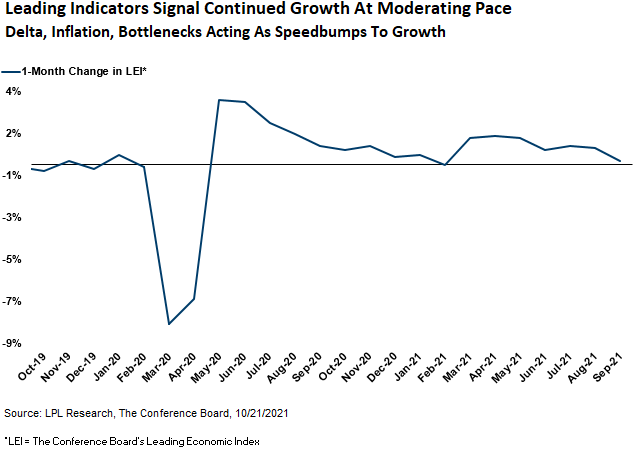

On Thursday, October 21, the Conference Board released its September 2021 report detailing the latest reading for the Leading Economic Index (LEI), a composite of ten data series that tend to lead changes in economic activity. Many economic data points are backward-looking, but we pay special attention to the LEI, as it has a forward-looking tilt to it and spans many segments of the economy. The index grew 0.2% month over month, the lowest reading since February and slightly below expectations for 0.4%. This does, however, mark the seventh consecutive month the index has risen.

“September’s LEI number plays into our view of an economy transitioning to mid cycle ,” said LPL Financial Chief Investment Strategist Ryan Detrick. “A mid-cycle economy tends to be bumpier than early cycle with more uncertainties on the horizon, but we expect near-term issues to resolve themselves giving way to the next leg of sustained growth.”

As seen in the LPL Chart of the Day, the LEI’s growth rate has slowed since early summer.

60% of the underlying component indexes rose in September, representing still-strong breadth even if that percentage fell from last month’s 80%. The Institute for Supply Management (ISM) New Orders Index, interest rate spread, and average weekly initial claims for unemployment insurance represented the three largest positive contributors. Building permits represented the largest drag on the index.

We continue to see strength on the demand side of the economic equation, supporting our belief that the economy will remain strong over the long-term. Supply has taken longer to come back online during this recovery because of widely publicized supply chain issues and still-elevated COVID-19 cases, exacerbated by poor weather. These issues will likely take some time to resolve themselves, but they are good problems to have compared to weak demand. We are starting to see evidence of “peak bottleneck,” suggesting economic activity may soon start to get a lift from improvement on the supply side.

Looking out into 2022, we anticipate healthy consumer balance sheets and strong wage growth will buoy the U.S. consumer, while businesses will likely invest more heavily in productivity-enhancing capital expenditures to meet that strong demand, potentially leading to above-average economic growth next year.

Much more on our economic outlook for next year coming soon in our Outlook 2022 publication in early December.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05204898