Markets End the Week Lower Amid Inflation Concerns

U.S. and International Equities

U.S. Markets Higher

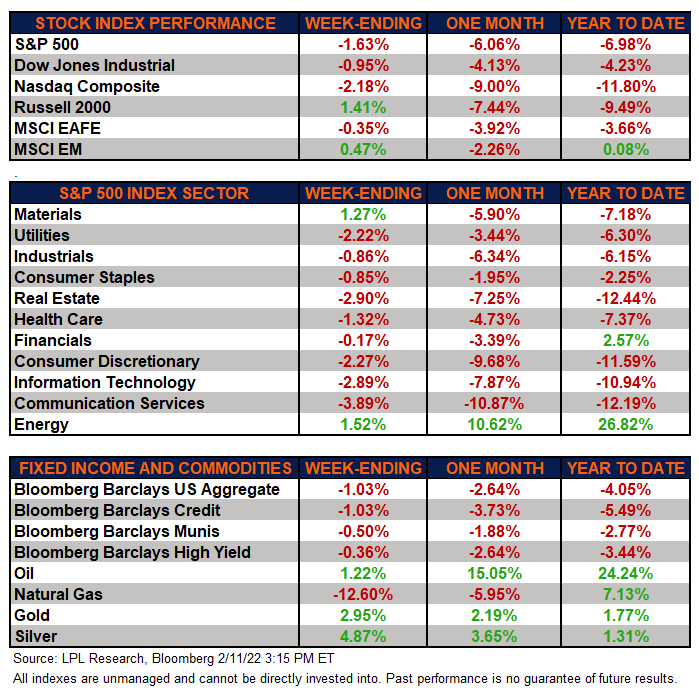

The major equity markets finished the week lower, failing to extend the rebound which started two Fridays prior, after the averages closed lower for the first three weeks of the New Year. Following the early year sell-off that saw inflation, higher interest rates, and tighter Federal Reserve (Fed) policy weighing on investor sentiment, traders picked up discounted shares earlier this week in light of improving fourth quarter earnings. However, Thursday’s hotter than expected January Consumer Price Index (CPI) reading gave some investors pause, leading to a late-week selloff.

International markets finished higher this week, with emerging markets (MSCI EM) outperforming most of their US and developed international counterparts. Emerging markets, which were last year’s regional laggard on the back of concerns over Chinese regulation and real estate debt challenges, are leading all the major market averages and are the only major average in the green for 2022.

Fixed Income Continues Lower

The Bloomberg Aggregate Bond Index finished lower for the fourth straight week. High-quality bonds continue to be challenged as traders sold off longer-term government bonds and priced in a more aggressive timetable for Fed rate hikes, especially in light of last month’s CPI report. This sentiment also carried over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, which lost ground this week.

Commodities Mixed

After a strong January, natural gas pulled back over 12% this week. In addition, crude oil finished higher this week as the commodity has seen a steady march higher this year. Gold, silver, and copper finished their second straight week in the green.

“It looks as though stocks have found their footing just a bit, although Federal Reserve policy expectations continue to drive the bus in terms of market sentiment,” explained LPL Research Senior Vice President and Director of Research Marc Zabicki. “We believe some market participants are forecasting more rate hikes than what actually may occur, but we agree that policymakers could begin raising rates at the March meeting.”

Economic Weekly Roundup

CPI Continues Hot

Per the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 7.5% year over year in January, higher than economists expected. Moreover, January’s reading marks the ninth consecutive month above 5% for the Consumer Price Index. Core CPI, which excludes food and energy, increased 6.0% year over year. This came in slightly higher than economists’ forecasts as well as above December’s CPI reading. In addition, January’s core CPI reached the highest level since 1982.

Jobless Claims Decline Again

Initial claims for unemployment insurance declined for the week ending February 5 and were just under 223,000, surpassing economists’ consensus expectations. Continuing claims were unchanged from the prior week. We expect claims to potentially see further declines over the next several weeks.

Small Business Optimism Continues to Decline

The National Federation of Independent Business Small Business Optimism Index for January fell from under 99 to just over 97. This was below economists’ expectations and was the lowest reading since February 2021. As was the case for much of 2021, inflation and challenges finding workers remain key concerns among small business owners in early 2022. Moreover, the percentage of businesses raising prices was the highest since 1986 while the percentage boosting compensation was the highest ever recorded on the survey.

Week Ahead

The following economic data is slated to be released during the week ahead:

- Tuesday: January Producer Price Index

- Wednesday: January Export/Import Price Index, capacity utilization, industrial production, December business inventories, February National Association of Home Builders Housing Market Index, January Retail Sales

- Thursday: Weekly initial and continuing unemployment claims, January housing starts and building permits

- Friday: January existing home sales, leading indicators

Next week, over 50 S&P 500 companies will report their fourth quarter 2021 earnings results.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05244294