Stocks and Inflation

As we continue LPL Research’s Inflation Week, today we will examine how stocks have historically done at different inflation levels. For more color on our views on inflation, please read here and here, and look out for tomorrow’s blog, where we’ll examine some of the factors that have kept inflation low and that will likely continue to put a lid on inflation in the future.

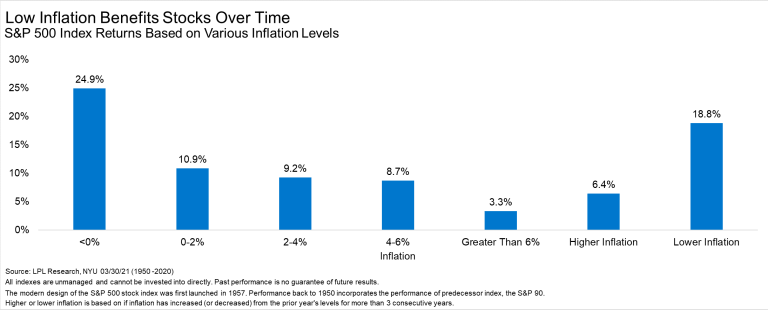

Looking at S&P 500 Index returns going back to 1950, stocks have tended to like low inflation. As shown below, the lower inflation is, the better the S&P 500 Index returns tend to be, although the strong performance for negative inflation may be due to markets rebounding off of lows. Taking it a step further, if inflation is trending lower, then stocks do much better (18.8% on average) versus if inflation is trending higher (6.4% on average).

“You can’t argue with history, as it sure appears that inflation that’s under control is a tailwind for stocks,” explained LPL Chief Market Strategist Ryan Detrick. “It is when inflation starts to turn higher that it can knock stocks down. Given our base case is for modest inflation, this is another feather in the cap for the bulls.”

Looking at a scatter plot of inflation and the S&P 500, there is a fairly wide dispersion in some cases, so this is by no means a perfect indicator. Still, the regression line moves from the upper left to the lower right, suggesting lower inflation indeed historically has benefitted stocks more than higher inflation.

The inflation question is one that isn’t going away, especially as the US continues to add more fiscal and monetary stimulus. Although this isn’t a very consensus call, we think inflation will be capped once we get past 2021 and this should help stocks overall.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05128424