Third Quarter Earnings Season Preview

We have used most of the superlatives we know to describe corporate America’s stunning performances over the past two earnings seasons. Despite lofty expectations, results exceeded estimates by huge margins. We expect solid earnings gains during the upcoming third quarter earnings season, but upside surprises will almost certainly be smaller.

“We think earnings growth will be strong again this quarter,” explained LPL Financial Equity Strategist Jeffrey Buchbinder. “But those looking for massive upside surprises and big increases in estimates will probably be disappointed. The COVID-related supply chain disruptions and labor and materials shortages have held corporate America back some in recent months.”

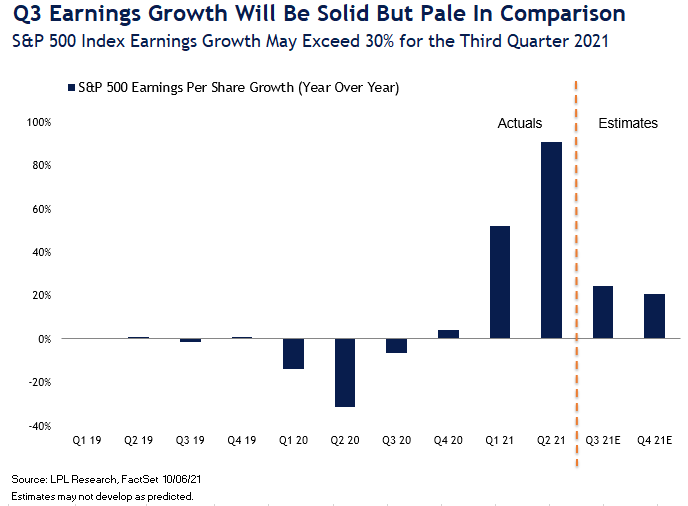

After year-over-year S&P 500 Index earnings growth of 52% and 90% in the first and second quarters, shown in the LPL Chart of the Day, and massive upside surprises compared with expectations, the third quarter will probably look different. Upside surprises are likely to be more in line with history (potentially 6-8 percentage points above) and the overall increase will be smaller, perhaps in the mid-to-high 30% range.

Beyond those widely-reported supply chain challenges facing corporate America, there are other reasons to expect results this quarter to be closer to expectations. The latest batch of company pre-announcements has been less positive than in recent quarters, and estimates have stopped rising.

Earnings season kicks off this week with 19 S&P 500 companies slated to report, highlighted by several large banks. Look for a more in depth earnings season preview in our next Weekly Market Commentary on October 18, 2021.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index data from Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05200188