Three Things Investors Can Learn From Phil Mickelson’s Win

Congrats to Phil Mickelson on his amazing victory on Sunday at the PGA Championship at the age of 50, officially the oldest person to ever win a golf major championship. This was Lefty’s 6th major victory, leaving him just a win at the U.S. Open from completing golf’s Grand Slam and winning all four majors. He turns 51 the day before teeing off at Torey Pines for next month’s U.S. Open where he will try to join Gene Sarazen, Ben Hogan, Gary Player, Jack Nicolaus and Tiger Woods as the only players to ever complete the Grand Slam.

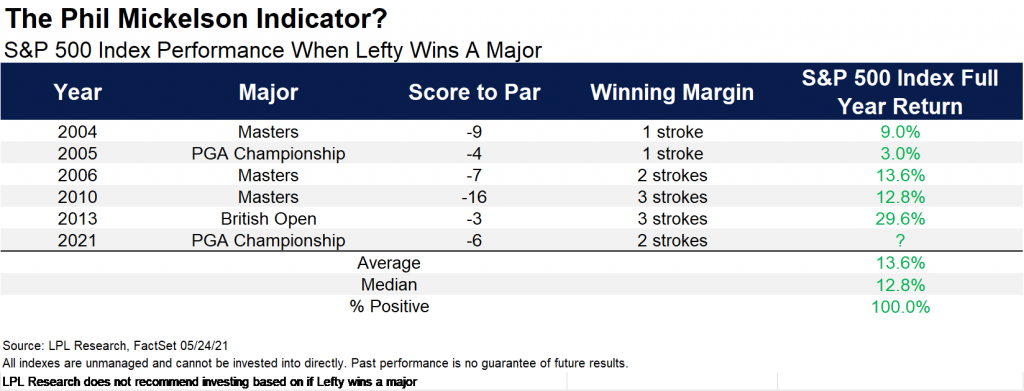

First things first, does the victory tell us anything about future equity performance? “Of course his victory is totally random in regards to stock performance, but we think it is worth at least noting that stocks gained each of the previous 5 years he won a major,” explained LPL Financial Chief Market Strategist Ryan Detrick, “So at least it isn’t a bad sign!”

You have to hand it to Phil for his amazing victory at the age of 50, beating golfers half his age, while also hitting it further than most of them. His physical transformation is astonishing. Thanks to his new diet (he fasts 36 hours a week!) and exercise, he has turned back the clock and is in the best shape of his life at 50. He has also played in at least one major every year since 1990, which is the type of experience you simply can’t read in a book.

What can investors take away from Phil’s amazing victory? First off, we think it is being open to change. He changed his entire lifestyle to be able to compete with much younger athletes. But change isn’t always positive.

One of the best ways to show that things will change and you better be ready for it is this great chart from Credit Suisse that shows the size of various country stock markets relative to the rest of the world at the end of 1899 and then at the start of this year. Here are some major takeaways.

- The U.S. stock market made up 15% of the global market in 1899 and rose to 55.9% by 2021.

- The UK was the largest stock market in the world at 24% in 1899 but fell to only 4.1% in 2021.

- Japan’s stock market is 7.4% of the global market now but wasn’t even on the board back in 1899.

Change is inevitable and investors can benefit from being open to it and prepared for it. Being close-minded won’t help you in your personal life or in your investments.

Experience is the second big takeaway from Lefty’s win. He knew how to react to the pressure, as he’s been there many times over the years. What is something that experienced investors might know that a novice doesn’t? We’d say it is knowing your history. Experienced investors understand that markets move in major cycles that can last decades or more. As shown in the LPL Chart of the Day, the S&P 500 Index can make new highs for decades at a time and then it can go nearly just as long without a new high.

Some interesting stats on the chart above:

- The S&P 500 made no new highs for 24 years after the peak in 1929.

- From 1954 to 1968 the index made 371 new highs.

- Then the next 11 years it made only 35 new highs.

- This kicked off the bull markets of the 1980s and 1990s, which resulted in 509 new highs over the next 20 years.

- From 2000 through 2012 though the S&P 500 made only 13 new highs.

- We are now nine years into a cycle of new highs with 301 new highs, which history would say could be followed by many more years of new highs.

The final takeaway from Phil’s win is time can be your friend. “It all depends on your investment horizon, but it is important to remember that if you invest for the long-term, you’ll probably make a positive return on your investments,” according to Ryan Detrick. “In fact, the S&P 500 has been higher nearly two-thirds of all years, but that goes up to 80% over three years, and the index has never been lower over any 25-year investment timeframe.” How many people sold stocks during the depths of the pandemic last March, even though they likely didn’t need that money for many years, or even decades?

We hope you enjoyed this blog and here’s to Phil winning next month in San Diego and completing the Grand Slam!

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05148488