Down Week Puts U.S. Stocks Near Correction Territory

U.S. and International Equities

U.S. Markets Lower

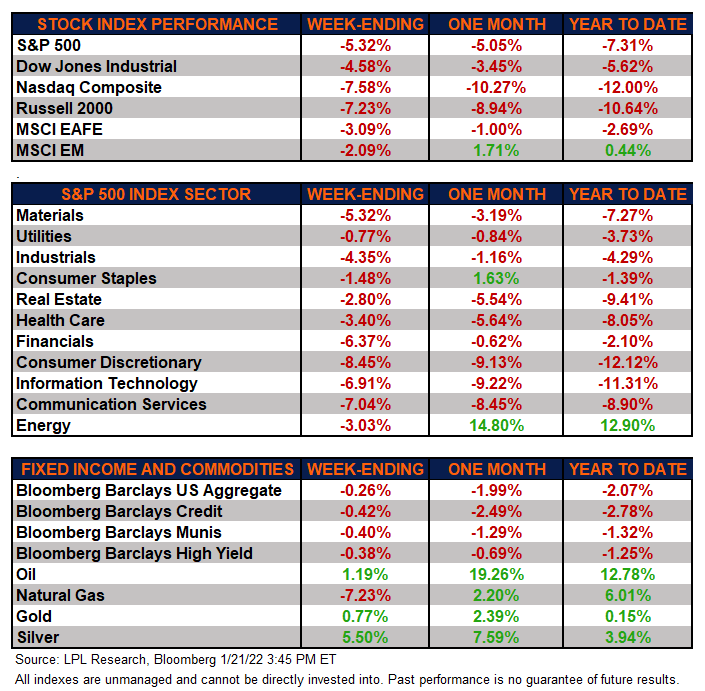

The major equity markets finished the week lower as inflation, higher interest rates, and tighter Federal Reserve policy continue to be front and center on investors’ minds. Moreover, disappointing outlooks from some widely followed tech companies amid relatively high growth equity valuations are putting downward pressure on stock prices.

International markets finished lower this week, but topped the U.S. major markets. Emerging markets, which were last year’s laggard on the back of concerns over Chinese regulation and real estate indebtedness, continue to lead the major markets in 2022 despite finishing lower for the week.

Fixed Income Reverses Last Week’s Gains

The Bloomberg Aggregate Bond Index finished lower this week, reversing all of last week’s gains. High-quality bonds remain challenged as traders sold off longer-term government bonds on inflation concerns and priced in a more aggressive timetable for Fed rate hikes. This sentiment carried over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, as these bonds lost ground this week reversing course from last week’s gains.

Mixed Week for Commodities

After beginning 2022 on a high note, natural gas gave back last week’s gains by pulling back over 7%. In addition, oil continues its solid start to the New Year, gaining over 1% for the week. The major metals, gold, silver, and copper, also finished higher for the second straight week following a difficult 2021.

Economic Weekly Roundup

U.S. Housing Starts Rise

U.S. homebuilding increased to a nine-month high in December amid a sharp increase in multi-family housing projects. Housing starts rose almost 1.5% to a seasonally adjusted annual rate of over 1.7 million units last month, the highest level since March. Homebuilding numbers were strong even as soaring material prices continue to affect builders as the government almost doubled duties on Canadian softwood lumber. These increased costs could very well play a role in the direction of the housing market in 2022.

Jobless Claims Rise Sharply

Initial claims for unemployment insurance increased again for the week ending January 15, reaching over 280 thousand, surpassing economists’ expectations. The weekly total increase is likely related to the latest Omicron driven surge in COVID-19 cases. Continuing claims also rose to over 1.63M, surpassing economists’ expectations.

The following economic data is slated to be released during the week ahead:

- Monday: January composite Purchasing Manager Index, Markit Purchasing Manager Index

- Tuesday: January consumer confidence, November Federal Housing Finance Agency Home Price Index, S&P Case-Shiller Home Price Index

- Wednesday: December building permits and wholesale inventories

- Thursday: Weekly initial and continuing unemployment claims, December durable orders, pending home sales, Q4 GDP

- Friday: December personal consumption expenditures

Next week, over 100 S&P 500 companies will report their fourth quarter 2021 earnings results. And the Federal Reserve holds its two-day policy meeting on Tuesday and Wednesday, January 25-26.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05235447