Growth Stocks Catch a Bid Amid Renewed COVID-19 Worries In Europe

U.S. and International Equities

Major Markets Mixed

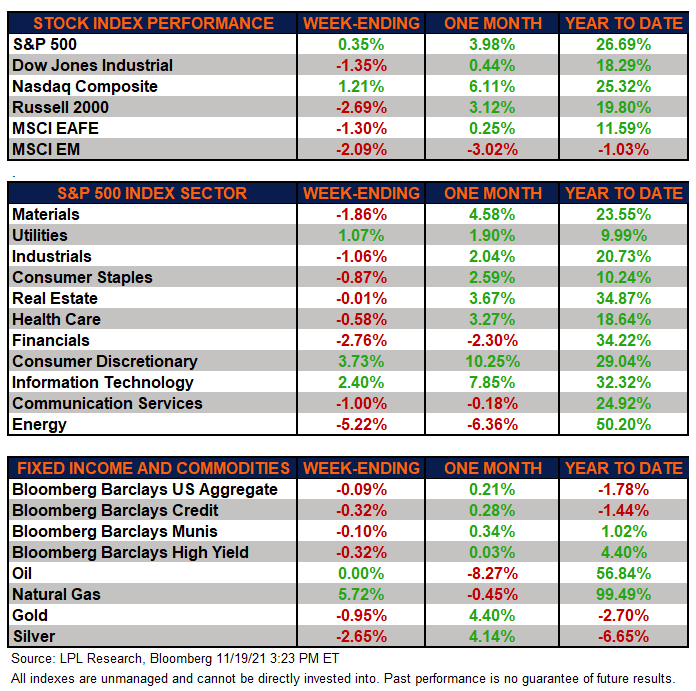

The major equity markets finished the week mixed as inflation worries continued to play a role in investors’ minds amid an excellent third quarter earnings season. International equities, as represented by the developed international (MSCI EAFE) and emerging markets (MSCI EM), lost ground as COVID-19 cases rebounded in Europe. Concerns over China’s continued regulatory crackdown and its economic trajectory also weighed on investor sentiment.

This week, growth names performed well compared to their value counterparts on the back of higher COVID-19 cases worldwide as potential lockdowns could spur increased business for the stay-at-home stocks.

Earnings, Earnings, Earnings

Earnings have been quite exemplary considering the challenges companies are facing as supply chain disruptions and materials and labor shortages affect the global economy. As we conclude quarterly reporting season, earnings are tracking to an almost 40% year-over-year increase for the third quarter, 12 percentage points above the October 1st consensus estimate. On average the largest upside surprises came from the energy, financials, and utilities sectors.

This week’s results from big-box retailers, which could be seen as being directly affected by supply-chain issues, mostly beat analysts’ expectations.

Bonds Reverse Course

The Bloomberg Aggregate Bond Index finished lower for the second consecutive week as yields increased on inflation concerns. Moreover, high-yield corporate bonds, as tracked by the Bloomberg Barclays High Yield index, sold off for the second straight week as well.

Commodities Finish Slightly Lower

Natural gas prices rallied this week, however they only retraced approximately a quarter of last week’s pullback. Oil finished breakeven after having dropped for three straight weeks as weekly inventory data showed more supply build than anticipated. Both gold and silver pulled back this week on profit taking after two consecutive higher weeks for the metals.

Economic Weekly Roundup

Solid October Retail Sales

Amid inflation concerns along with the Delta variant, the consumer remains resilient. October retail sales again bested expectations, producing the largest monthly gain since March. Moreover, September retail sales were revised higher, further surpassing economists’ expectations.

Leading Economic Index Point toward Moderate Growth

The Conference Board released its October Leading Economic Index (LEI) this week, showing a rebound from September. Year-over-year growth, at over 9%, accelerated for the first time since April, indicating low odds of a recession occurring in the next 6 months. Please read more about last month’s LEI through the LPL Research blog post Leading Indicators Show Tempered Optimism For Economy.

Unemployment Claims Steady

Initial claims for unemployment insurance were reported at over 260,000 for the week ending November 13. The report came in slightly above expectations. The four-week moving average of claims has now fallen to near 270,000, which is the lowest since the pandemic began. That being said, this is still about 50,000 above pre-March 2020 levels.

The following economic data is slated to be released during the holiday-shortened week ahead:

- Monday: October existing home sales

- Tuesday: November Markit Purchasing Managers Index (PMI)

- Wednesday: Weekly initial and continuing unemployment claims, October building permits, personal consumption expenditures, personal income, new home sales, wholesale inventories, November University of Michigan sentiment, Federal Open Market Committee (FOMC) minutes

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05215255