Markets Begin Year On A Weak Note

U.S. and International Equities

Major Markets Lower

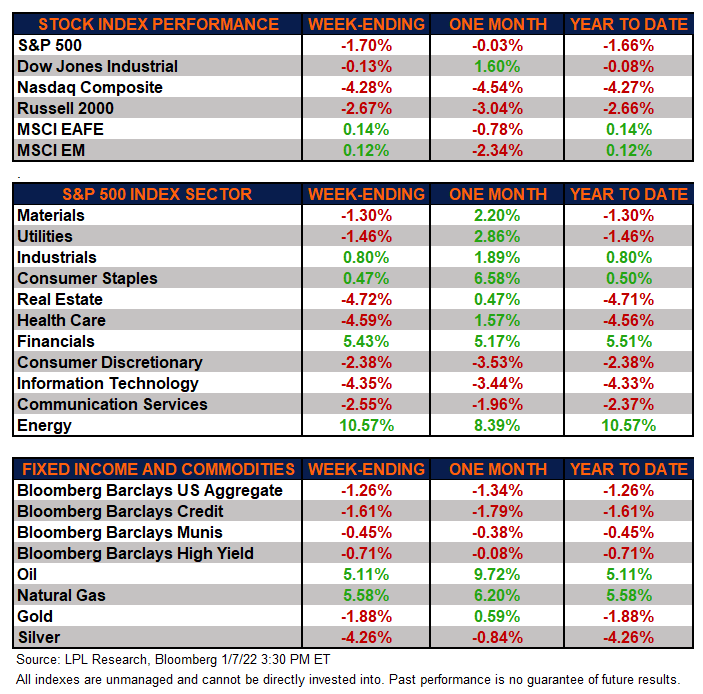

The major equity markets finished the week lower, as concerns about inflation and interest rates intensified after the Federal Reserve’s (Fed) minutes were released this week. Growth stocks, as represented by the Nasdaq composite, lost more ground compared to the S&P 500 Index on the back of higher 10-year yield Treasury rates.

International markets reversed course Friday to end the week on positive footing. The financial and energy sectors led the markets this week on the back of higher interest rates along with a gradual OPEC supply production boost that will, most likely, not keep up with worldwide demand.

Fixed Income Lower

The Bloomberg Aggregate Bond Index finished lower for the first week of the New Year. High-quality bonds had a rough December and first week of January as traders sold off longer-term government bonds on inflation concerns and priced in a more aggressive timetable for Fed rate hikes. This sentiment also carried over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, as these bonds lost ground to begin 2022.

Commodities Mixed

Natural gas started 2022 on a high note after gaining over 40% last year. This week, the commodity appreciated over 4%. In addition, oil had a solid start to the New Year, gaining over 5%. The major metals finished lower this week, with both gold and silver continuing their treks lower following a difficult 2021 despite inflation concerns.

Economic Weekly Roundup

Fed talk

The Fed released the meeting minutes from its December policy meeting this week. The release further confirmed that the Federal Open Market Committee (FOMC) remains concerned about elevated inflation readings. The minutes indicated that the Committee continued to view mid-March as an appropriate end date for net asset purchases and that rate hikes may happen “sooner or at a faster pace” than previously anticipated. In addition, the minutes noted that “some” participants said that it could be appropriate to start balance sheet runoffs “relatively soon after beginning to raise the federal funds rate”.

Disappointing News on the Jobs Front

Initial claims for unemployment insurance continue to come in near multi-decade lows. For the week ending January 1, they came in at just above 200,000. Continuing claims increased to just over 1.75 million.

For the month of December, the Bureau of Labor Statistics reported that the U.S. economy added just under 200,000 jobs in December, well short of the consensus expectation of 450,000. This was the second straight large miss. The unemployment rate fell for the sixth straight month to 3.9% and a new pandemic low, while the labor participation rate remained unchanged at 61.9%. This report is disappointing with fewer jobs, faster wage growth, and lack of progress on labor participation. That being said, last month’s lower unemployment rate is a silver lining.

The following economic data is slated to be released during the week ahead:

- Monday: November wholesale inventories

- Tuesday: NFIB December Small Business Index

- Wednesday: December consumer purchasing index, hourly earnings, average workweek, Treasury budget

- Thursday: Weekly initial and continuing unemployment claims, December producer price index

- Friday: December export/import prices, retail sales, capacity utilization, industrial and manufacturing production, November business inventories, January University of Michigan sentiment

Next week will also bring the start of fourth quarter 2021 earnings season with several big banks reporting results on January 14.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05230432