Markets End The Year On A Strong Note

U.S. and International Equities

Major Markets in the Green

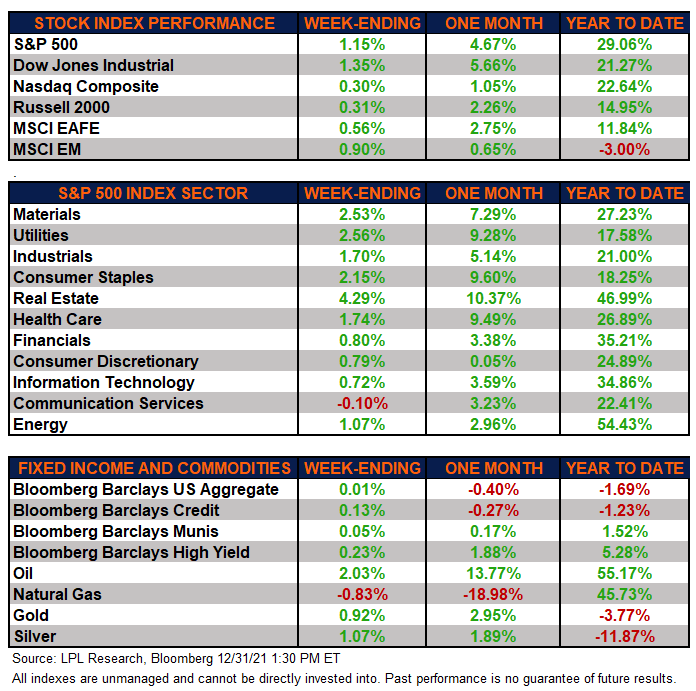

The major equity markets finished the week higher, as the Santa Claus rally continued to take hold even amid concerns about the Omicron variant’s effects on the economy. Nevertheless, the Federal Reserve’s (Fed) hawkish stance on inflation continues to weigh on investor’s minds. Real estate enjoyed a strong week as well as an excellent 2021, as investors saw opportunity in the sector given its income producing properties and potential to act as an inflation hedge.

International markets also caught a bid for the second straight week despite continuing to battle an increase in COVID-19 cases. Gains in emerging markets for the week topped those in developed markets, as markets seemed to look past the Chinese real estate giant Evergrande’s second debt default.

Fixed Income Higher

The Bloomberg Aggregate Bond Index finished marginally higher this week. High-quality bonds had a tough December as traders sold off longer-term government bonds on inflation concerns. This sentiment did not carry over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, as these bonds continued their run ending 2021 on solid footing.

Commodities Mostly Higher

Natural gas finished lower this week and is down over 15% for the month while oil finished the week higher. The major metals were relatively unchanged this week with both gold and silver ending lower in 2021 despite inflation concerns.

Economic Weekly Roundup

Pending Home Sales Decline

November pending U.S. home sales dropped by over 2%. Economists had estimated that pending home sales would increase month-over-month by 0.5%. Reasons for this decline include relatively high home prices across the country.

Housing demand increased early in the onset of COVID-19 given increased demand for living in less densely populated area that accommodated working from home. Moreover, the housing market simmered during the first half of 2021 as low inventory increased prices beyond the reach of many potential home buyers. It appears these conditions may affect housing demand going into 2022.

Employment Claims Below 200k

Initial claims for unemployment insurance continue to come in near multi-decade lows and were reported at just under 200,000 for the week ending December 24, while continuing claims declined to near 1.7 million. This is the third reading below 200,000 in the past six weeks, and it sends the less-volatile four week moving average of claims below 200,000 for the first time since 1969.

Although labor statistics such as the labor force participation rate remain far from ideal, the labor market landscape remains tight. We continue to believe the current standing of the labor market will do little to prevent the Fed from increasing rates presuming inflation continues to rise into 2022.

The following economic data is slated to be released during the week ahead:

- Monday: Markit December Purchasing Managers’ Index, November construction spending

- Tuesday: December Institute for Supply Management Manufacturing Report, November JOLTS Job Openings

- Wednesday: December ADP Employment Survey, Purchasing Managers’ Index composite, Markit Purchasing Managers Index Services Report

- Thursday: Weekly initial and continuing unemployment claims, November trade balance, durable goods and factory orders, December Institute for Supply Management Non-Manufacturing Report

- Friday: December employment report, including hourly earnings, average workweek, manufacturing and nonfarm payrolls.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05227950