Markets March Higher Despite Omicron

U.S. and International Equities

Major Markets higher

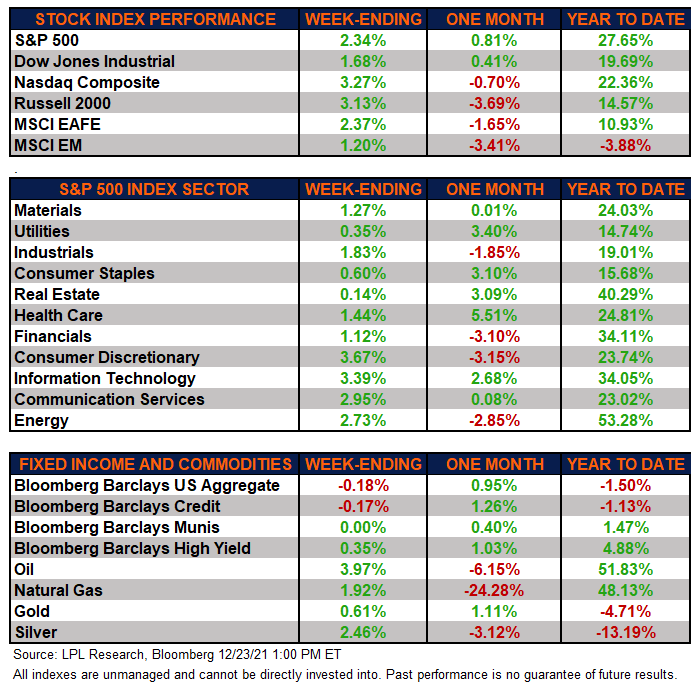

The major equity markets finished the week higher, as the Santa Claus rally took hold even amid concerns about the Omicron variant’s effects on the economy. The growth style paced the market’s gains, with particular strength in the consumer discretionary and technology sectors that powered the Nasdaq Composite to an even bigger weekly advance than the S&P 500 Index. Moreover, the Federal Reserve’s (Fed) hawkish stance on both inflation and thus interest rates also continue to weigh on investor’s minds. International markets also caught a bid this week as these nations continue to battle an increase in COVID-19 cases, though gains in emerging markets for the week lagged those in developed markets.

Fixed Income Mixed

The Bloomberg Aggregate Bond Index finished lower this week. High-quality bonds lost ground as traders sold off longer-term government bonds on inflation concerns while continuing to digest the Fed’s newly hawkish stance. This sentiment did not carry over to high-yield corporate bonds, as tracked by the Bloomberg High Yield index, as these bonds continued their run after enjoying an excellent 2021.

Commodities Marginally Higher

All major commodities finished the week in the green. Gold and silver both had positive weeks as traders demanded these traditional inflationary plays. Moreover, natural gas finished higher this week, breaking three straight weeks of lower returns. Natural gas is off over 20% for the rolling one-month period.

Economic Weekly Roundup

December Consumer Confidence Solid

The Conference Board reported this week that consumer confidence rose in December, while November’s number was revised upward as consumers end 2021 on a more optimistic note. The proportion of consumers planning to purchase homes, automobiles, major appliances, and vacations over the next six months all increased. Moreover, consumer concerns about inflation declined after reaching a 13-year high last month, along with concerns about COVID-19. This report points to positive signs for the economy next year as consumer demand is a vital driver of the economy.

Personal Consumption Expenditure Met Expectations

The personal consumption expenditures (PCE) price index, the Fed’s preferred measure of inflation, showed broad increases last month but generally met economists’ expectations. Year-over-year, the PCE headline number came in over 5.5% while core PCE, taking out food and gas prices, jumped over 4.5%. Most numbers were increases over the month prior, however personal spending and personal income showed deceleration from October. Nevertheless, the headline rate of inflation was the highest since 1982, while core rose at its fastest since 1989, supporting the Fed hawkish monetary view.

Employment Claims Unchanged from Prior Week

Initial claims for unemployment insurance continue to come in near multi-decade lows and were reported at just over 200,000 for the week ending December 18, while continuing claims continued to fall slightly, reaching over 1.8 million. Although labor statistics such as the labor force participation rate remain far from ideal, the labor market landscape remains tight. We continue to believe the current standing of the labor market will do little to prevent the Fed from increasing rates presuming inflation continues to rise into 2022.

The following economic data is slated to be released during the week ahead:

- Tuesday: Federal Housing Finance Agency October Home Price Index, October S&P Case-Shiller Home Price Index

- Wednesday: November wholesale inventories, November pending home sales

- Thursday: Weekly initial and continuing unemployment claims

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking #1-05226175