MARKETS SELLOFF AMID FED POLICY

U.S. and International Equities

Major Markets Lower

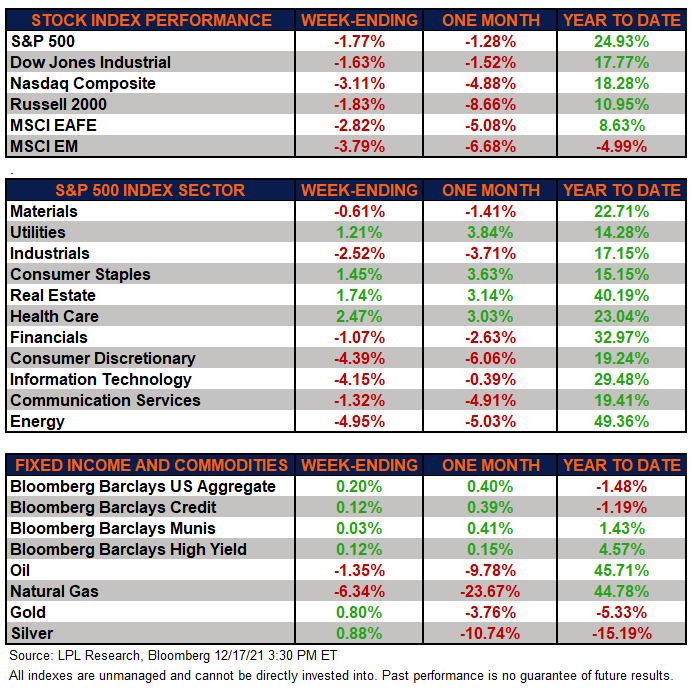

The major equity markets finished the week lower, reversing some of last week’s gains on the back of this week’s Federal Open Market Committee (FOMC) meeting. The Federal Reserve (Fed) took a hawkish stance on both inflation and thus interest rates. Growth sectors (information technology and consumer discretionary) lagged the market on this news given the relatively higher interest rate sensitivity of future profits. Both emerging and developed international equities followed the lower U.S. markets.

High Quality Bonds Rally

The Bloomberg Aggregate Bond Index finished higher this week. High-quality bonds caught a bid as traders reduced risk following the Fed meeting and sent long-term bond yields lower. This sentiment carried over to high-yield corporate bonds, as tracked by the Bloomberg Barclays High Yield index, as these bonds continued their run after having an excellent performance during the prior week.

Commodities mixed

Commodities finished the week mixed as traders took solace in the Fed’s message this week. Gold and silver both had positive weeks as traders moved into these traditional inflationary plays. Moreover, natural gas continued its slide for a third straight week as the commodity finished over 6% lower.

Economic Weekly Roundup

Fed Talk

The Fed ended its two-day FOMC meeting on Wednesday with some notable shifts to monetary policy, which were largely expected by the markets. The Fed is now expected to end its asset purchases completely by March of next year. Moreover, the Fed believes three interest rate hikes are warranted in 2022. Three months ago, the Fed was evenly split between rate hikes starting in 2022 and 2023.

Producer Price Index Higher than Expected

The Producer Price Index (PPI) increased 0.8% month over month in November which was well above economists’ consensus. Excluding food and energy, core PPI rose 0.7% month over month. This was also above economists’ expectations. Supply chain disruptions and thus producer inflation is putting upward pressure on consumer prices. That being said, we believe that producer inflation could peak in December and begin to ease in early 2022, helping to bring down consumer inflation beginning in the spring.

Jobless Claims above 200k; Continuing Claims below 2M

Initial claims for unemployment insurance were reported at just over 200,000 for the week ending December 11, while continuing claims continued to fall, reaching over 1.8 million. Even though some statistics such as the labor force participation rate remain far from ideal, the labor market landscape remains tight. This endorses the view taken by the Fed this week that the labor market is healthy enough to warrant a more hawkish view.

The following economic data is slated to be released during the week ahead:

- Monday: November leading indicators

- Tuesday: Q3 current account

- Wednesday: Q3 Gross Domestic Product, December consumer confidence, November existing home sales

- Thursday: Weekly initial and continuing unemployment claims, November durable orders, core personal consumption expenditures and income, new home sales, building permits, December University of Michigan consumer sentiment

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.

This Research material was prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1-05224371