Retails Sales Shifting to Slower Growth

Retail sales rose 0.6% month over month in August following July’s downwardly revised 0.9% advance, but sales fell short of Bloomberg’s consensus expectation for a 1% increase. The retail sales control group, which excludes building materials, autos, and gas, fell 0.1% month over month and also missed estimates (source: US Census Bureau).

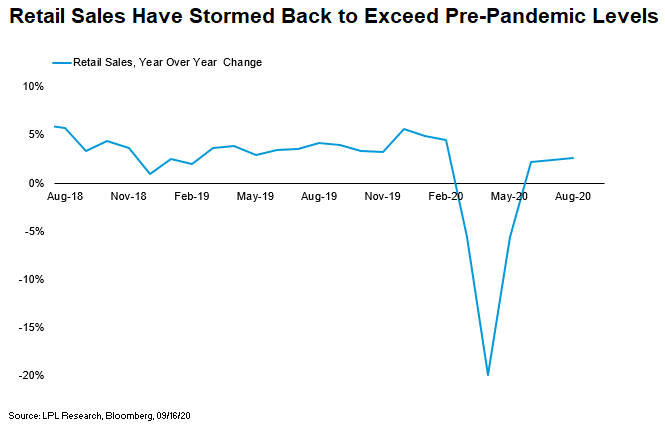

The speed of retail sales’ recovery to pre-pandemic levels—just five months—has been remarkable, although the July 31 expiration of supplemental jobless benefits provided a headwind during the important back-to-school shopping season. During the 2008–09 financial crisis, retail sales did not return to their prior peak for more than three years!

As shown in the LPL Chart of the Day, sales in August 2020 were 2.6% higher than in August 2019, impressive given the impact of the pandemic and lockdown recession. Some restrictions have eased but many remain in place, making this rebound particularly impressive. August sales were 1.9% above the levels back in February, when the numbers were inflated by an 8.5% year-over-year increase in grocery store sales on some early shelf-stocking.

“Retail sales’ ability to remain above pre-pandemic levels is remarkable considering the shrinking boost from supplemental jobless benefits while social distancing and business restrictions have continued,” said LPL Financial Equity Strategist Jeffrey Buchbinder. “We expect steady gains to continue as more restrictions are eased and consumer confidence is restored, though still-high unemployment and dwindling stimulus make the road ahead a bit tougher.”

Looking at the various segments, sales gains were supported by the continued recovery in restaurants, up 4.7% (but still down 17% year over year), and housing-related spending. Weak spots included food sales, sporting goods (off elevated levels), and department stores. E-commerce sales continued to chug along, growing 20% year over year but were unchanged from July’s levels.

The consumer recovery from the pandemic has been impressive despite the shortfall in August retail sales. Fading stimulus and still-high unemployment may slow the pace of consumer spending growth this fall, but the progress to date is encouraging.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05056227