What Happens After The First Rate Hike?

“Don’t fight the Fed.” Old investment saying

One of the popular questions we’ve received lately is what do stocks do after the first rate hike? Let’s be clear, we think the Federal Reserve Bank (Fed) will leave rates low until at least 2023, but what if we get a sudden dose of inflation? This isn’t our base case, but a rate hike could potentially happen sooner in that situation.

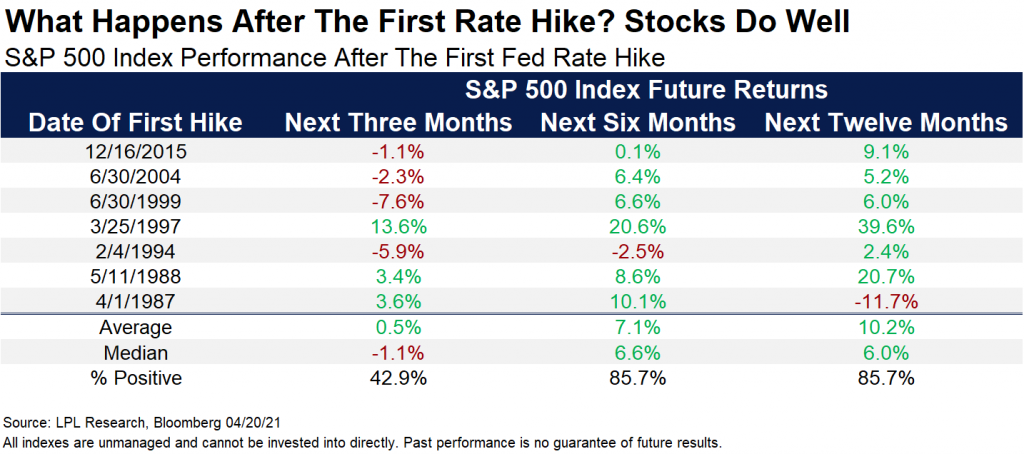

After all, the first rate hike in 2015 set off a huge sell-off into early February 2016, as the market was quite upset and let it be known that it felt the Fed acted too soon. In fact, the first hikes of 2004 and 1999 also saw losses the first three months after the first hike, but eventually stocks were in the green a year later.

“The first hike in recent cycles has indeed brought with it some selling pressure, but hikes usually take place in strong economies, so it isn’t surprising to see returns turn green once you go further out,” explained LPL Financial Chief Market Strategist Ryan Detrick. “But let’s not sound any alarms yet, we don’t see a rate hike for a couple of years. Still, it’s good to know what the playbook could be once it happens.”

As shown in the LPL Chart of the Day, that initial rate hike can cause some hiccups the first three months, but returns turn much better 6- and 12-months later.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking # 1- 05136069