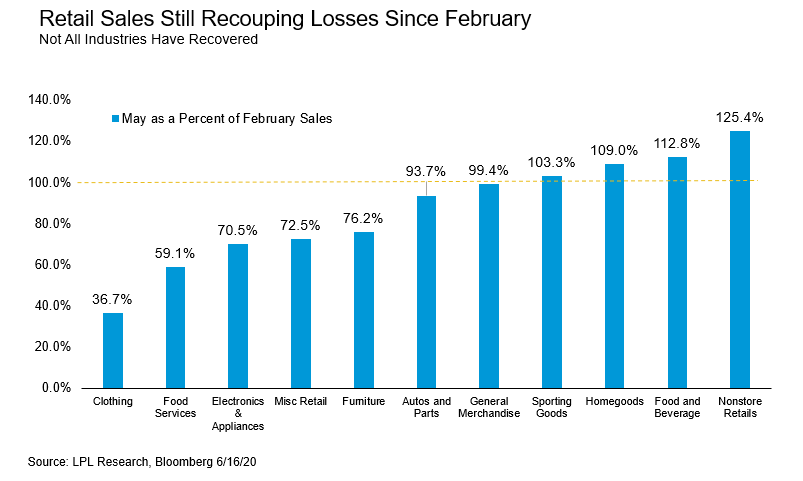

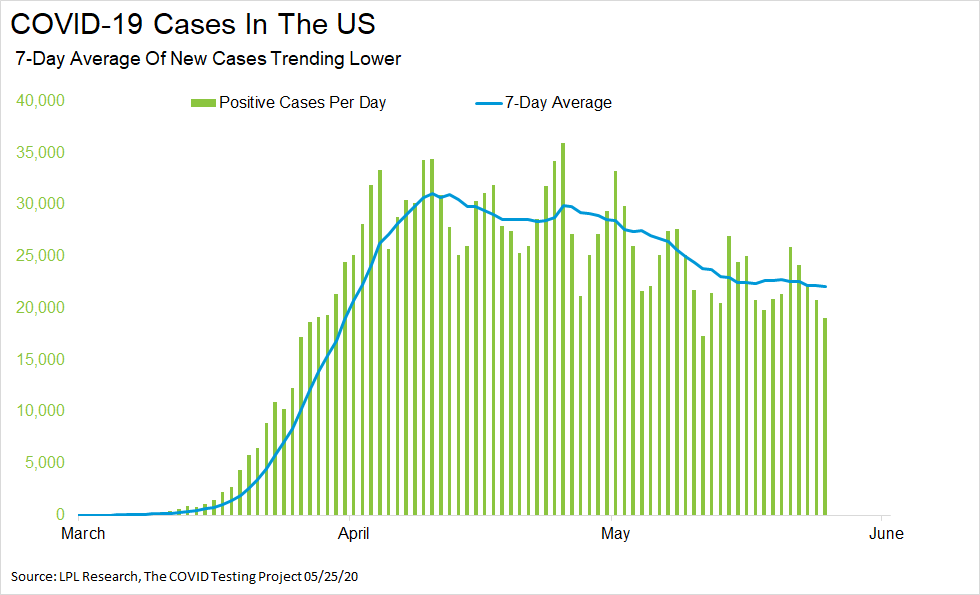

COVID-19 has decimated global demand as lockdowns materially re-shaped consumer and business behavior. Even as states have begun to re-open, significant questions remain about how demand could recover. The May retail sales print provided one of the first glimpses of that answer, rising 17.7% month over month and marking the largest monthly gain since data […]

Retail Sales Beat Shows Consumers Coming Back Strong